Recordkeeper Integration Overview

Summary

This document provides a summary of the work involved in integrating with Morningstar Investment Management LLC’s Morningstar® Retirement ManagerSM, Managed Accounts, and/or Advisor Managed Account services. Throughout this documentation Managed Accounts refers to both service offerings. If there is a requirement specific to Advisor Managed Accounts, it will be called out as Advisor Managed Accounts. When offering both Morningstar® Retirement ManagerSM and Advisor Managed Accounts, all information for both service offerings can be sent in one file. Morningstar Investment Management will provide separate documentation that will include all the detailed specifications needed to integrate with the Managed Accounts product.

Technical Specifications

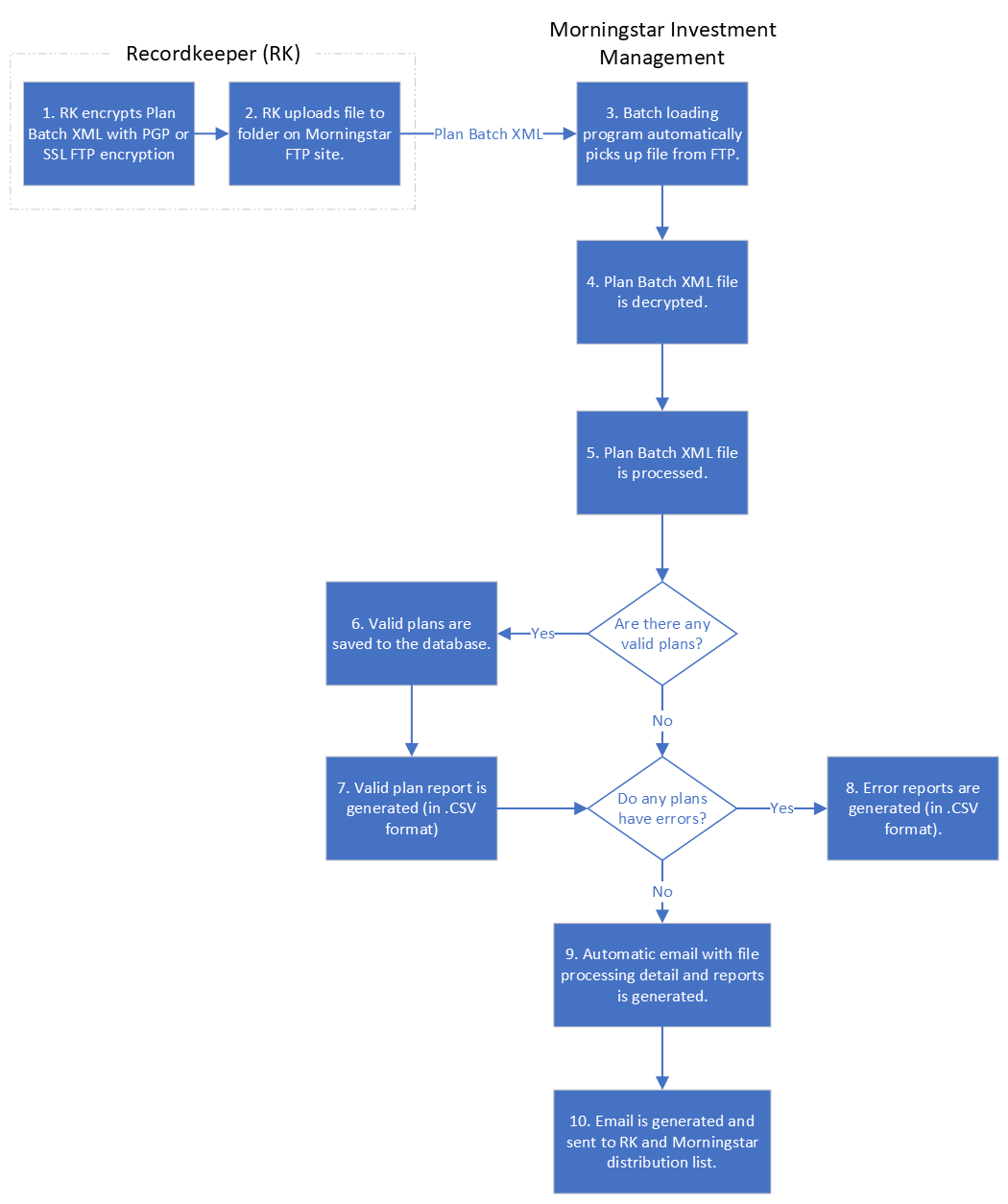

1. Plan Setup — Batch Import Process

When a plan offers Morningstar Investment Management services, the Recordkeeper must send the plan rules and fund information (fund lineup details) to Morningstar Investment Management. An appropriate plan batch file tells Morningstar Investment Management about plans, plan types, rules and what service options are offered by the plan. Plan batch files must precede participant processing, i.e., plans must be established on the Morningstar Investment Management system before participants in those plans can be successfully processed.

This file should be created using the PlanBatchImport_3.1.xsd schema provided by Morningstar Investment Management. New required fields for Advisor Managed Accounts include the AdvisoryFirmID. Based on the registered investment adviser’s (RIA) direction, a plan should be able to toggle the following service options: Managed Accounts (QualMRP), Point-in-Time Advice (OnlineAdvice), Call Center (OnlineCallCenter), and Participant Outreach (Proposal).

Image 1: Batch Import Process

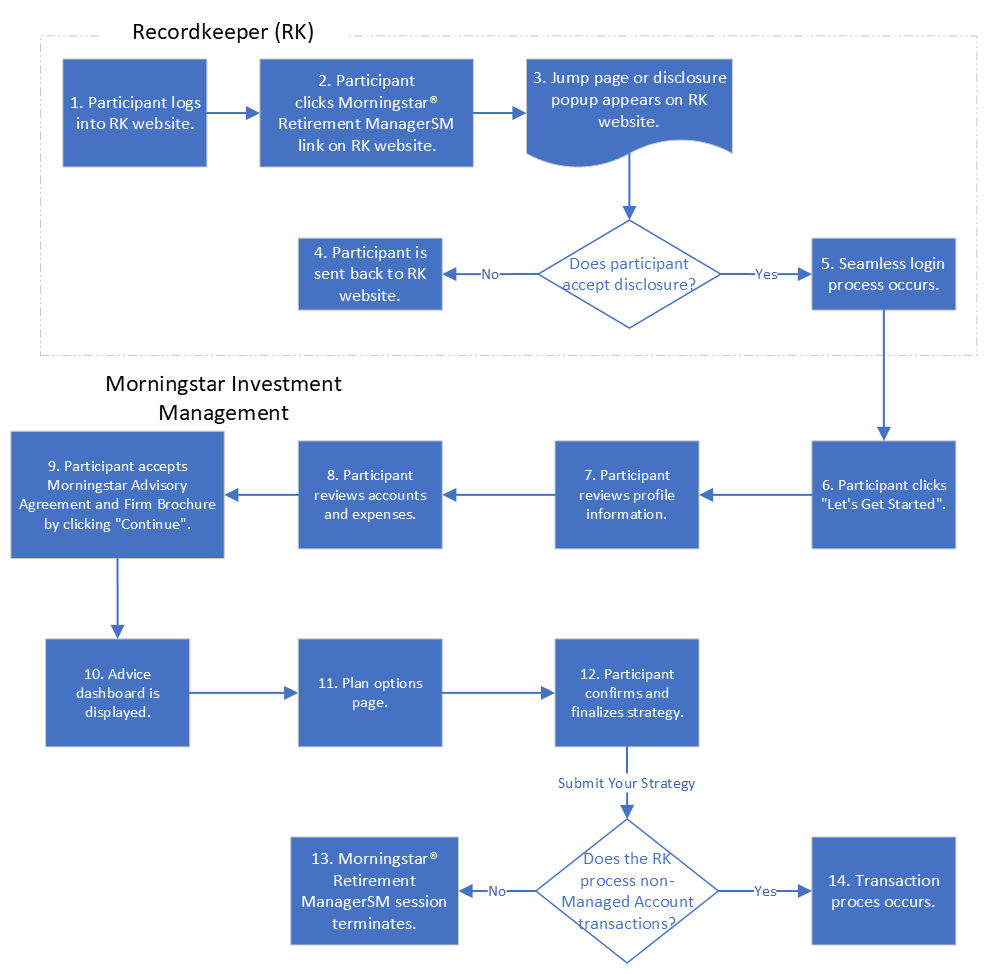

2. Recordkeeper/Morningstar Investment Management Real-Time Website Integration Process

Participants in plans that offer Morningstar Investment Management’s services will need to have access to the service through the Recordkeeper’s website. The Recordkeeper will need to provide a link for the participant to access Managed Accounts (see section #3). Morningstar Investment Management will work with the Recordkeeper on the location and display of the link. Data will be securely transferred from the recordkeeping system and used to pre-populate participant data in the Morningstar® Retirement ManagerSM or Advisor Managed Account user interface.

Participants can provide additional information or make changes to their data at any time through the Managed Accounts website which may result in a transaction being sent to the Recordkeeper. If the Recordkeeper does not maintain contribution rate/amount changes on their system, this information does not have to be sent back in the transaction string. Managed Accounts transactions can be sent as a result of participant enrollment, opt-out, rebalancing, or material participant changes on the website (updates).

In the same manner that participants enrolls into Managed Accounts (via batch or the web), they can opt-out of the service as well. As with the enrollment process, the opt-out process also triggers a transaction to be sent to the Recordkeeper; in this case, it is for the purpose of opting out of the service. By opting out, a flag will be set to “un-enroll” and participants must, subsequently, be able to make transfers/reallocations and future investment elections directly through the Recordkeeper’s website.

Image 2: Real-Time Website Integration Process

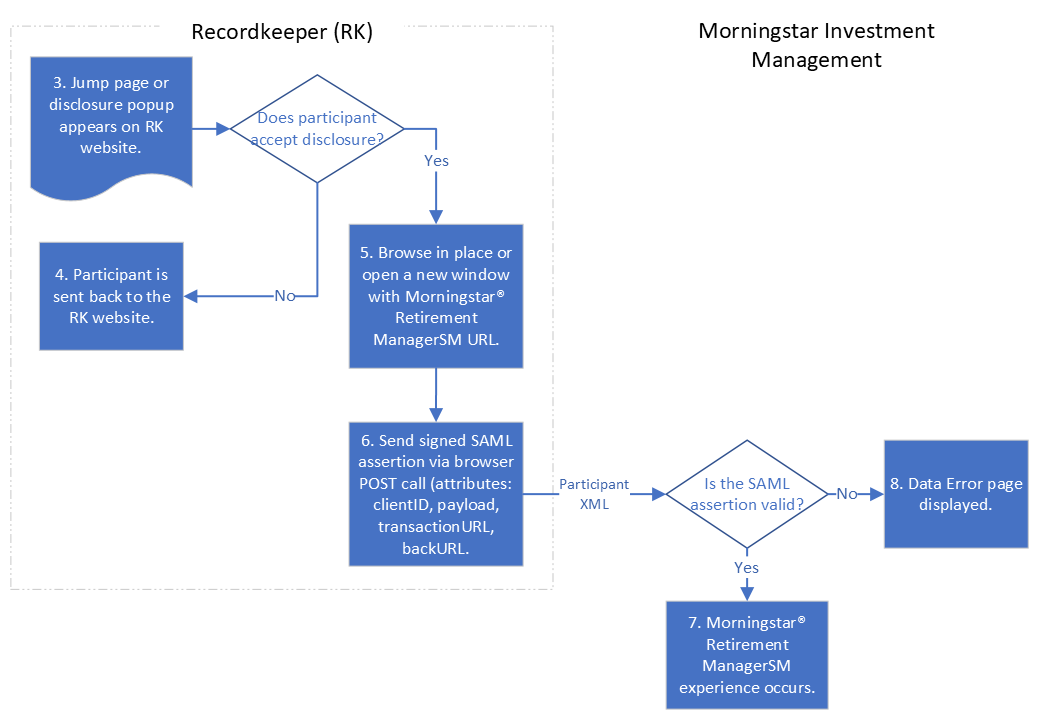

3. Create a link to the Managed Accounts System

Participant log into the Recordkeeper’s website. Upon clicking the Morningstar® Retirement ManagerSM link or the Advisor Managed Accounts link, participants will be taken to the Morningstar® Retirement ManagerSM home page or Advisor Managed Accounts Home page without needing to log in again. This will be done via the single-sign-on process. The Images 3 flow is a subset of the flow in Image 2. The payload node for the SAML assertion will use the Real-time Participant xml (RealTimeParticipantInput.xsd and ExternalParticipantData_2.1.xsd) schemas.

Image 3: Subset of Image 2.

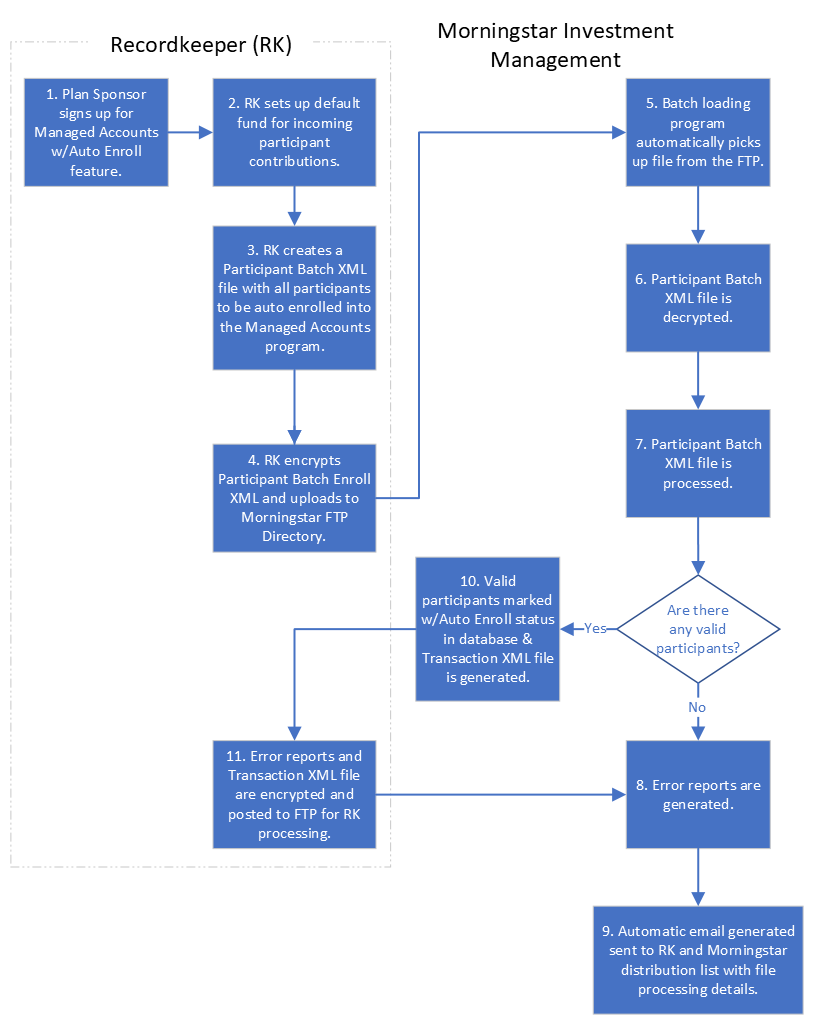

4. Automatic Participant/QDIA Enrollment — Batch

Automatic enrollment is an effective means of combating participant inertia and automatically enrolling participants into advisor managed accounts. The process involves plan coordination with Morningstar Investment Management and the sending of a batch participant enrollment file to Morningstar Investment Management designated for auto enrollment. When setting up the plan, the Recordkeeper must identify the plans to be set up for auto enrollment. Based on the type of auto enrollment selected, the Recordkeeper must identify which participants are enrolled in the plan but have elected to not use auto enrollment. The batch xml file will use the following schemas ExternalParticipantData_3.1.xsd and BatchParticipantInput.xsd. Please note that the same schemas are used for batch enrolling participants into plans as well and it follows almost the same process outlined below.

Image 4: Automatic Enrollment Flow

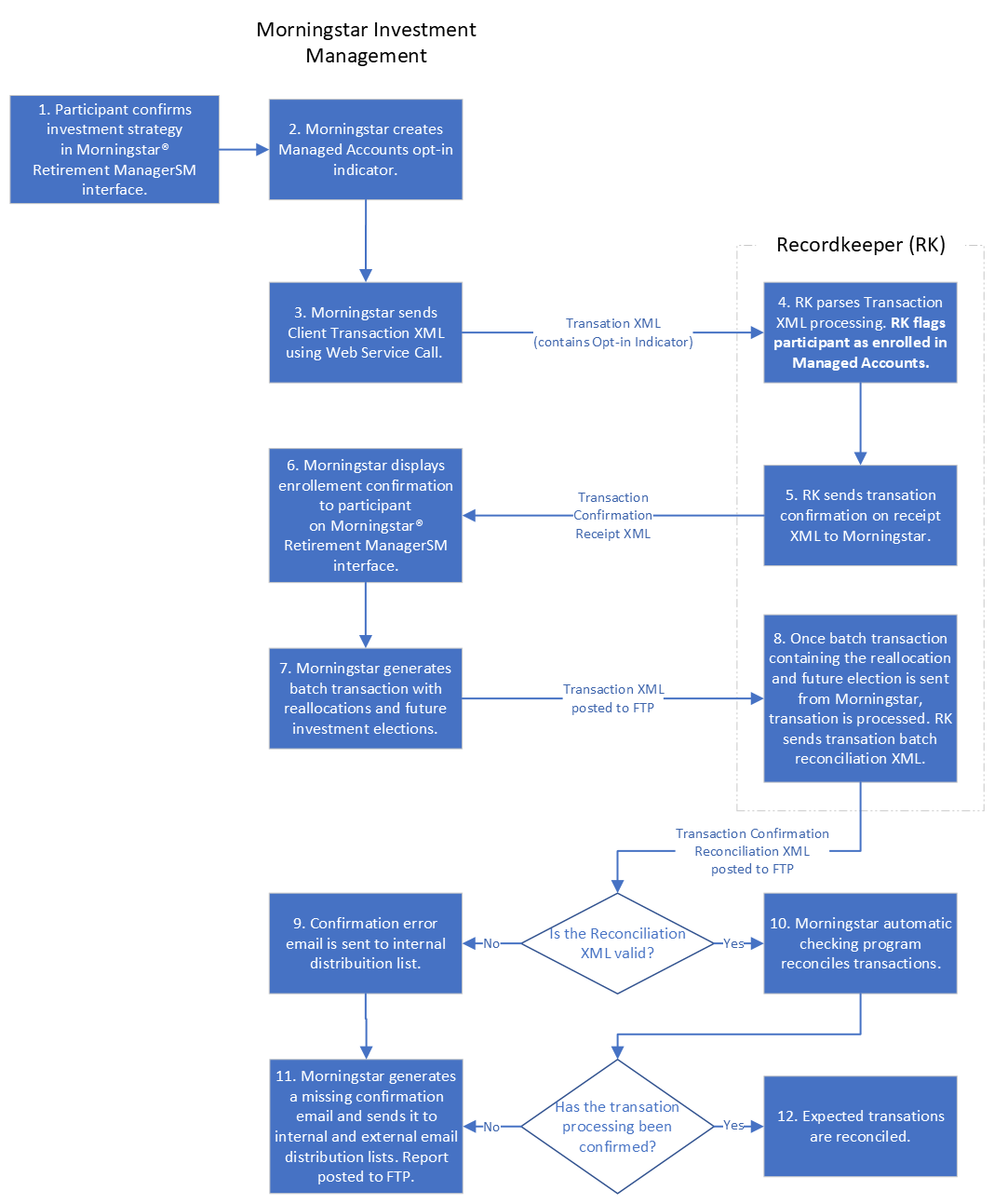

5. Transaction Processing — Web Service and Batch

Managed Accounts will send transactions to the Recordkeeper’s system throughout the day. Transaction processes uses the following schemas Transaction_3.1.xsd, CommonTypes_3.1.xsd, and CFTransConfirm.xsd. For web enrollment, participants can choose between the Advice (if offered) or Managed Accounts services if a plan is eligible for each service as determined by the plan batch file. All advice usage and advice transactions and confirmations (Recordkeeper acknowledgement of receipt of transactions) are done real-time, through the website. There is no batch processing for advice except for the plan batch file.

Managed Accounts Batch Transaction Processing

If Morningstar® Retirement ManagerSM Managed Accounts or Advisor Managed Accounts service is chosen on the web and a participant proceeds with the recommendations, an enrollment “transaction” (transaction in this context does not contain reallocations, but an indication that the participant is now enrolled in the service) is sent to the Recordkeeper and the Recordkeeper returns a confirmation of receipt with success/error code and message to Morningstar Investment Management. For most Recordkeepers, managed accounts transactions (containing reallocations, future elections, and contributions, if appropriate) are sent in a transaction batch file from Morningstar Investment Management to the provider. The Recordkeeper returns a batch trade confirmation file to Morningstar Investment Management on a scheduled basis that will be used for reconciliation and to derive any transaction failures. The reconciliation process uses the unique tracking ID sent in each transaction. This tracking ID is returned by the Recordkeeper in the transaction reconciliation file to Morningstar Investment Management. Unreconciled transactions, as indicated by a report, must result in appropriate correction and reprocessing within 10 business days or Morningstar Investment Management may have to opt the participant out of the service. There is a multi-stage communication process that occurs before a participant is opted out because of an un-reconciled transaction.

Batch Transaction Processing Data Flow

Image 5: Batch Transaction Processing Data Flow

Real-Time Transaction Processing

Some Recordkeepers can process real-time web transactions for Managed Accounts where reallocations and future investment elections are included in the real-time transaction. Morningstar Investment Management supports this process by posting these real-time transactions to a web service endpoint owned and/or hosted by the Recordkeeper. Morningstar Investment Management supports Web services that follow the SOAP Web Service or REST API standards. Please refer to the Single Sign On Specification document. When real-time web transactions are sent with reallocations and future investment elections, a UI batch transaction will not be generated. Real-time confirmation is needed from the Recordkeeper indicating successful receipt of the real-time transaction and intent to process the transaction.

6. Restrictions for Participants in Managed Accounts

The enrollment transaction contains a flag that tells the Recordkeeper to mark a participant as “enrolled” in their system. Thereafter, a participant must be blocked from making transfers/reallocations or investment election changes directly on the Recordkeeper’s website. This is because Morningstar Investment Management/RIA is the fiduciary once a participant enrolls. The Recordkeeper needs to consider a process for allowing participants to sell company stock and assets in a brokerage window, if applicable. A participant can continue to make other requests, such as changing their contribution rate, requesting a loan, etc., through the Recordkeeper’s website.

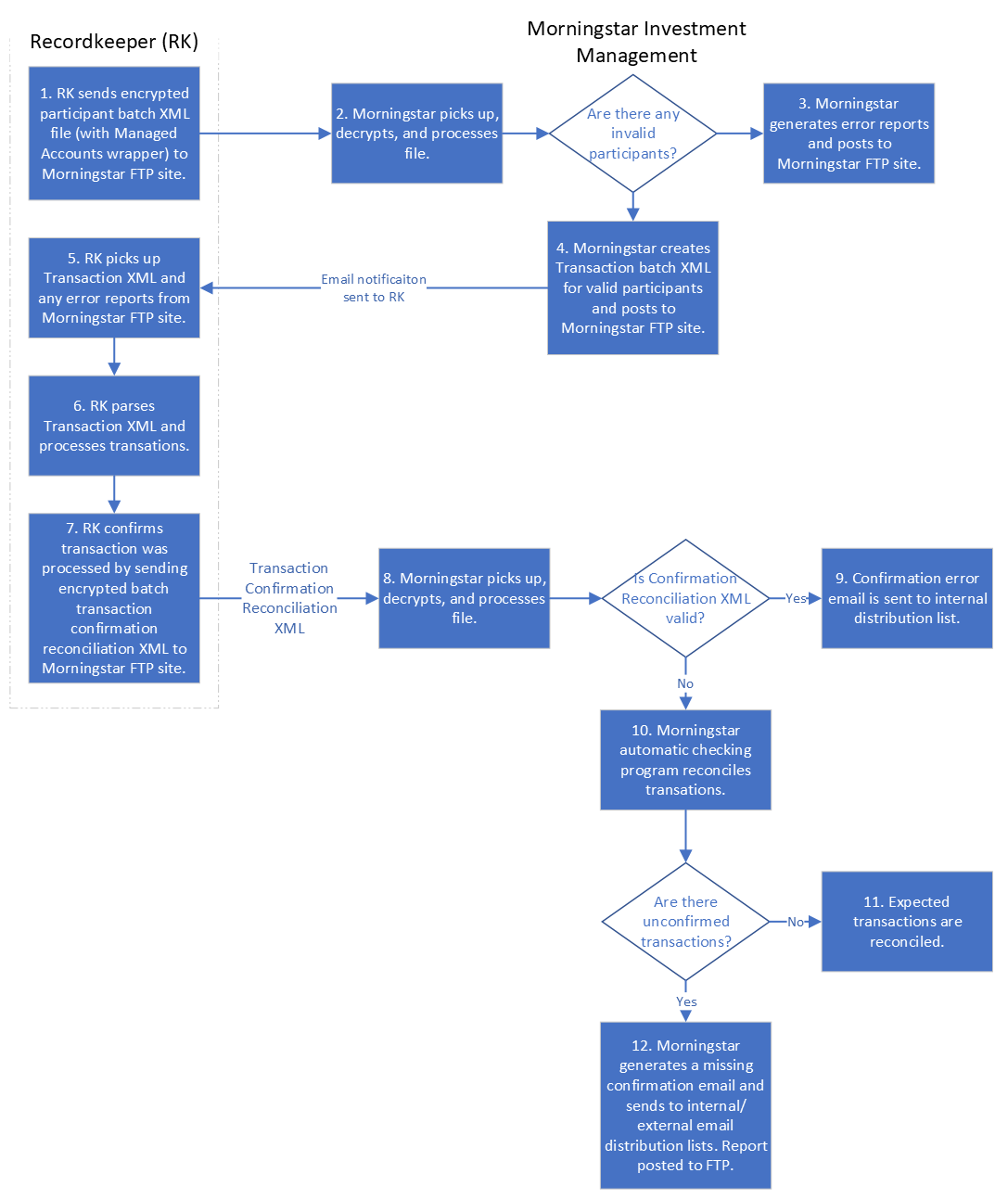

7. Managed Accounts Service Rebalance Process — Batch

The Recordkeeper will need to send quarterly batch files to Morningstar Investment Management that contain data for all participants enrolled in the Managed Accounts service using the ExternalParticipantData_3.1.xsd and BatchParticipantInput.xsd) schemas. Morningstar Investment Management processes this data and sends the Recordkeeper a resulting batch transaction file. The Recordkeeper returns a batch transaction confirmation file to Morningstar Investment Management. After the quarterly rebalance process, this file will contain transaction confirmations that are a result of quarterly file processing. The Recordkeeper daily trade confirmation file is used by Morningstar Investment Management to reconcile transactions and derive any transaction failures. Transaction files will use the following schemas Transaction 3.1.xsd, CommonTypes_3.1.xsd, and CFTransConfirm.xsd and will be posted to the FTP for the Recordkeeper to retrieve.

Please note that the process below is also used for the batch enrollments process as well (#4).

Image 6: Managed Accounts Service Rebalance Process

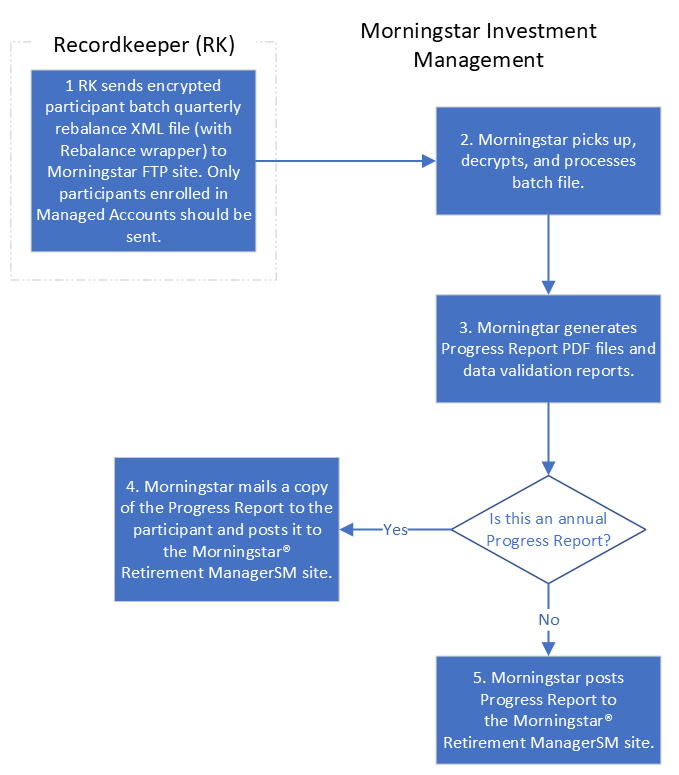

8. Progress Report Generation — Batch

Participants enrolled in Morningstar® Retirement ManagerSM Managed Accounts or Advisor Managed Accounts will receive a quarterly Progress Report (PR) from Morningstar Investment Management. PR generation occurs after rebalancing and is based on the participant rebalance file. The PR is available on the Advisor Managed Accounts website or Morningstar® Retirement ManagerSM website and additionally, a hard copy will be mailed to participants annually. The Progress Report will update participants on their progress toward their retirement goal, a balance tracker, investment performance, and a detailed analysis of the portfolio being managed.

Image 7: Progress Report Generation

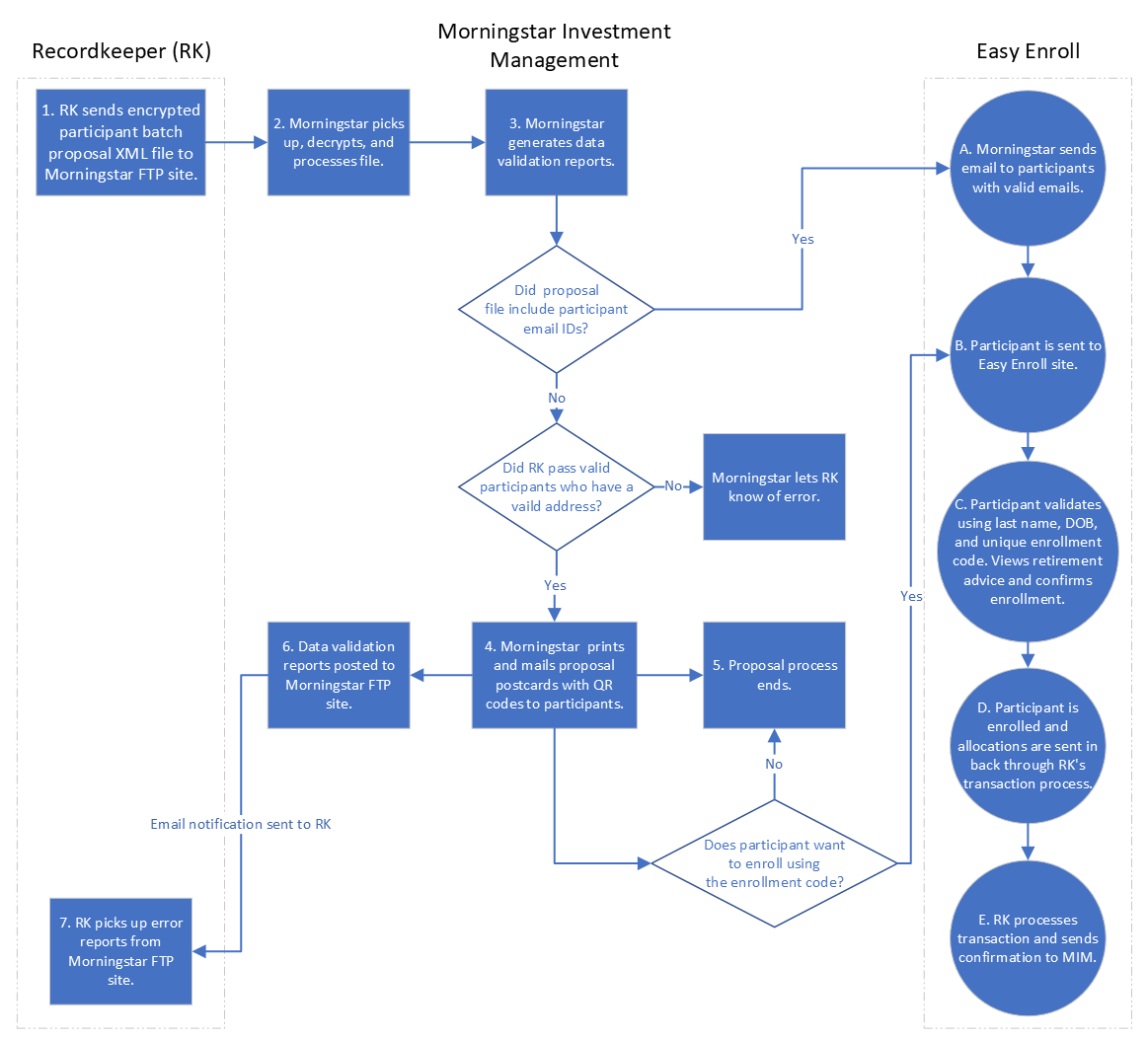

9. Participant Outreach (Proposal Report)

To drive participant education and enrollment into Managed Accounts, Morningstar Investment Management runs an email campaign every year for eligible plan participants. These campaigns inform participants about the offering and direct them to the Morningstar Investment Management Easy Enroll website[^1]. At this website, participants can receive personalized retirement advice after verifying they are eligible for the service. The advice includes savings, retirement age, and investment recommendations. It also shows participants how their retirement outlook looks as of today. After reviewing their advice, participants can initiate agreement to enroll into the Morningstar® Retirement ManagerSM Managed Account service or Advisor Managed Accounts right there on the website. Morningstar Investment Management will generate a batch transaction for the user to be included in a subsequent batch file that is posted to the client’s FTP. If a participant does not have an email address, Morningstar Investment Management will generate a Proposal Postcard containing a QR code that will navigate users to the Easy Enroll site when scanned.

Generally, clients break up their plan population into four different batches and send Morningstar Investment Management a participant batch proposal file on a quarterly basis for eligible participants that are not currently enrolled in the Morningstar® Retirement ManagerSM Managed Accounts service or Advisor Managed Accounts. By doing so, we contact each eligible participant once per calendar year.

Image 8: Participant Outreach

Checklist

- Code to the Managed Accounts schema specifications

- Code Managed Accounts plan XML schema file. For Advisor Managed Accounts, code the additional required data points needed for the service offering.

- Code Managed Accounts participant XML schema files with appropriate wrappers

- Setup process to encrypt all outgoing participant batch XML files sent to the FTP site

- Update system to store Managed Accounts service option at the plan level (at a minimum)

- Create a participant batch proposal XML file

- Setup process to send participant batch file for Participant Outreach (Proposal) for newly activated plans or new eligible participants with Managed Accounts

- Create a participant batch enrollment XML file

- Setup process to send participant batch enrollment file whenever participants sign up for Managed Accounts

- Program to send quarterly Managed Accounts participant batch rebalancing files of all participants enrolled in the Morningstar® Retirement ManagerSM Managed Accounts service or Advisor Managed Accounts to Morningstar Investment Management

- Setup process to pull from the FTP site and review any error reports that may be generated by Morningstar Investment Management for any batch files

- Program to add text and links to Advisor Managed Accounts and the Morningstar® Retirement ManagerSM Managed Accounts service on Recordkeeper website

- Code to single sign-on specs to allow participant access from Recordkeeper website to Advisor Managed Accounts site and the Morningstar® Retirement ManagerSM Managed Accounts service site.

- Program to receive and store real-time opt-in and opt-out indicators and dates for Managed Accounts participants from Morningstar Investment Management.

- Program to opt-out participants via participant batch XML file

- Program to download possible daily and quarterly Managed Account transaction batch files from FTP site

- Program to process Managed Accounts transactions received on a daily or quarterly basis

- Program to enable/disable transactional logic for Managed Accounts participants based on opt-in/opt-out indicators Morningstar Investment Management sends

- Program to send Morningstar Investment Management a transaction reconciliation file once transactions have been successfully processed

- Update system to accept and store transaction Tracking ID that Morningstar Investment Management sends in the transaction file at the participant level

- Create process to track account balances at the participant level for AUM fee calculation and deduction and send the all-in fee (Morningstar Investment Management, RIA (if applicable), and RK) via the plan xml file

- Program to calculate and deduct Morningstar Investment Management as well as the RIA’s portion (if applicable) of the fees for participants enrolled in Managed Accounts and the Morningstar® Retirement ManagerSM Managed Accounts service.

- Create a fee report for managed account fees deducted for enrolled users.

- QDIA Ppts: Program to suppress any trading fees and redemption fees from being applied to the participants account, during the first 90 days of enrollment. Managed Account fees will be charged for the 90 days at the end of the billing period. If a QDIA participant opts out during the 90 days, they would NOT be charged a prorated amount for the period that they were enrolled. Managed account fees for the first 90 days will be assessed after the first quarter of enrollment. Managed accounts fees include the RIA fee (if applicable), Morningstar Investment Management fee, and Provider Fee.

[^1]: This process uses a limited amount of participant information in creating recommendations and may not consider all information relevant to the participant’s financial situation. Morningstar Investment Management encourages participants who want a more personalized experience to use the full enrollment process instead of the streamlined process. The full enrollment process allows participants to provide additional information about their retirement situation and goals so that their retirement strategy is further customized. If participants have additional assets outside of their retirement plan, have a spouse or partner they’d like Morningstar Investment Management to consider, want to restrict certain securities from being used in their retirement account, or want to change the suggestions we’ve made for them or see how changes would impact their retirement strategy, participants should enroll using the full enrollment process.