Easy Enroll Requirements

Requirements

Proposal

The Proposal is a marketing campaign that features email or a postcard via physical mail that drives awareness and education of the managed accounts service, as well as provide participants with a streamlined journey to enroll in the service via Morningstar Investment Management LLC’s Easy Enroll Site. If a participant does not have an email address on file, they receive a single direct mail piece from Morningstar Investment Management LLC that drives them to the Easy Enroll site via a QR code. For the purposes of this document, 'PDF' and 'Postcard' reference the same item, a direct mail piece. The Proposal is available as part of the managed accounts service only. The Proposal can only be generated when the participant’s plan has the following service option combinations:

- QualMRP, OnlineAdvice, Proposal

- QualMRP, OnlineGuidance, Proposal

- QualMRP, Proposal

(The Proposal is not available for Guidance only plans)

Plan Data

The client will provide Morningstar Investment Management with the necessary plan data, in batch XML format, required to generate the Proposal. (Client should ensure that they only send data they are allowed to share with Morningstar Investment Management for marketing purposes under their privacy policy, and that such information is shared in accordance with any applicable regulations.) Plan data for the Proposal will be sent over in a plan batch file in schema format. ‘Proposal’ should be sent as a service option in the plan batch XML file in order to indicate that the plan offers the Proposal product.

Minimum Required Plan Data for the Proposal:

In addition to the data points that are required in the plan schema, the following data points are also required in order to generate the Proposal (the schema and/or data validation process will ensure Morningstar Investment Management receives these data points):

- Return Address (can be client level or plan sponsor level)

- Contact Web Address or Phone Number (Morningstar Investment Management can set up the web address and phone for th client in a configuration file if these values are static. These do not need to be sent to Morningstar Investment Management in the XML in this case.)

- Plan Fund Line-Up (sent as Tickers, Cusips, and/or CusFundIDs)

- Plan Name

A full list of required data points can be found below.

Please see the Participant Data Specification — XML document for more details.

Participant Data

Participant data for the Proposal will be sent over in a participant batch XML file in schema format. Participants who are to receive Proposals must be sent over in a participant batch file with the PDF wrapper, according to the requirements for the Morningstar® Retirement ManagerSM participant schema. Only active participants not yet enrolled in managed accounts, but that have managed accounts as a service option available to their plan, should be included in the Proposal participant batch XML file. Termed/Suspended/Inactive participants should not be included. A complete participant batch file containing all eligible participants who are to receive a Proposal must be sent over for each Proposal run.

Minimum Required Participant Data for the Proposal:

In addition to the data points that are required in the participant schema, the following data points are also required in order to generate the Proposal (the schema and/or data validation process will ensure Morningstar Investment Management receives these data points):

- Participant mailing address

- Gender

A full list of required data points can be found below.

Please see the Participant Data Specification — XML document for more details.

Full List of Required Data

Plan Data

- ClientID

- PlanID

- PlanName

- Type

- ServiceOption

- TransactionID

- Return Address (can be client level or plan sponsor level)

- Web Address or Phone Number

- Plan Fund Line-Up (sent as Tickers, Cusips, and/or CusFundIDs)

- ProgramFee

Specs: Please see the Participant Data Specification —XML document for more details.

Schema: PlanBatchImport_3.1.xsd. Please contact your Implementation Manager for guidance and questions.

Participant Data

- ClientID

- PlanID

- PlanType

- UserID

- FirstName

- LastName

- Date of Birth

- Address

- Account Balance

- Salary*

- Contribution Rate*

- Status

- Gender

- SSFlag (Optional)

- Pension (Optional)

Specs: Please see the Participant Data Specification — XML document for more details.

Schema: StatementParticipantInput.xsd. Please contact your Implementation Manager for guidance and questions.

*Salary and contribution data are required to generate advice and projections and should be included if available. However, we understand there are situations where Recordkeepers might not have that data to share. For participants with missing salary and contribution rates, the Easy Enroll UI displays input fields for participants to enter their salary and contribution rate to regenerate advice and projections. For an optimal user experience, this data should be included in the participant batch file if available.

Transaction Options

Easy Enroll is a mini enrollment journey built adjacent to Morningstar® Retirement ManagerSM (RM5). There are three supported transaction options for enrollments originating from site. All options relate to batch transactions.

Full Batch Transaction: Eligible participants who enroll in managed accounts via Easy Enroll will have a full transaction generated and sent to the client overnight via batch. This is a full transaction containing all necessary data points, reallocations, future elections, etc.

One Step – ToBeEnrolledMA flag: Some client systems require an ‘opt-in’ or 'enrollment' indicator be flipped on their systems prior to consuming a full batch transaction. In this option, an additional flag will be included in the UserTransaction node of the full transaction xml. Used to indicate the transaction originates from an Easy Enroll enrollment. Clients would use this attribute to make the necessary enrollment changes in their systems prior to consuming the full transaction.

Two Step – ToBeEnrolled xml: Similar to option #2, this solution is intended for clients who require an enrollment indicator be flipped prior to receiving a transaction. Instead of passing an additional flag in the transaction file, when a participant enrolls via Easy Enroll they're added to a separate "ToBeEnrolled" xml which will be passed to the client nightly via FTP. Clients process the file, flip their opt-in flag, and send back a standard batch enroll file containing the recently enrolled participants. From there, a full transaction is generated for the participant and sent back to the client for processing.

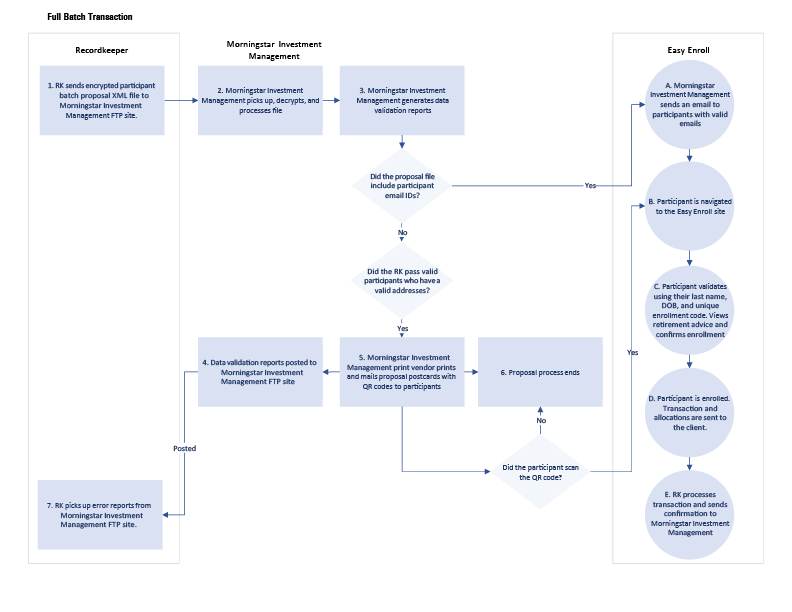

General Process Overview (Full Batch Transaction)

Client will provide the necessary plan and eligible participant data in batch XML format to Morningstar Investment Management. Eligible participant data is shared via FTP.

Morningstar Investment Management will validate client’s data. Error reports containing invalid plan and participant records will be delivered to client via the FTP site for corrections.

Morningstar Investment Management will process the valid data through the Morningstar Retirement Manager Proposal Engine.

Participants for whom an email is included will receive emails from the Morningstar marketing team with links to the Easy Enroll site, along with links to webinars to learn more about the Managed Accounts service.

If an eligible participant enrolls, a transaction is generated and sent to the client via one of the two transaction options listed on the previous page.

Client receives the transaction and processes. Client sends a confirmation to Morningstar.

Frequency – Morningstar Investment Management will process client’s Managed Accounts Proposal files on an agreed upon basis. Common frequencies are monthly, bi-monthly, or quarterly, Frequency can be discussed between Morningstar and the client.

Delivery – For email delivery, Morningstar Investment Management is responsible for sending emails to eligible participants. For eligible participants who don’t have email addresses, Morningstar Investment Management will deliver the Proposal postcard to its print vendor, CFG, who will be responsible for printing and mailing the Proposal postcard.

Note: Participants qualifying for the email campaign will not receive a direct mail piece.

Easy Enroll Process Full Batch Transaction

Note: No 'opt-in' transaction is sent prior to the full transaction. In the event a client system requires an 'opt'-in or 'enrollment flag' flipped prior to consuming the full transaction, an optional attribute can be included in the transaction to indicate the participant enrolled from an Easy Enroll campaign. The attribute FromCampaign="true" would be included in the UserTransaction node of the transaction XML. Clients should use this attribute to make the necessary enrollment change prior to consuming the full transaction. Please contact your implementation if this option works best for you.

<Transaction TimeStamp="2023-05-06T06:49:35.7561437-06:00" ClientID="clientID">

<UserTransaction TrackingID="trackingID" UserID="userID" FirstName="firstName" LastName="lastName" TimeStamp="2023-05-0ST06:49:35" FromCampaign="true">

<Account PlanID="planID" ServiceOption="QualMRP" Type="401K" Status="Active">

<Reallocation>

<Security TransactionID="test" Perc="l" IsCS="false" />

<Security TransactionID="test" Perc="l" IsCS="false" />

<Security TransactionID="test" Perc="l" IsCS="false" />

<Security TransactionID="test" Perc="l" IsCS="false" />

<Security TransactionID="test" Perc="l" IsCS="false" />

<Security TransactionID="test" Perc="l" IsCS="false" />

</Reallocation>

<FutureElection>

<Security TransactionID="test" Perc="l" IsCS="false" />

<Security TransactionID="test" Perc="l" IsCS="false" />

<Security TransactionID="test" Perc="l" IsCS="false" />

<Security TransactionID="test" Perc="l" IsCS="false" />

<Security TransactionID="test" Perc="l" IsCS="false" />

<Security TransactionID="test" Perc="l" IsCS="false" />

</FutureElection>

</Account>

</UserTransaction>

<UserTransaction TrackingID="trackingID" UserID="userID" FirstName="firstName" lastName="lastName" TimeStamp="2023-05-05T08:25:44" FromCampaign="true">

<Account PlanID="planID" ServiceOption="OnlineAdvice" Type="403B" Status="Active">

<Reallocation>

<Security TransactionID="test" Perc="l" IsCS="false" I>

<Security TransactionID="test" Perc="l" IsCS="false" I>

<Security TransactionID="test" Perc="l" IsCS="false" I>

<Security TransactionID="test" Perc="l" IsCS="false" I>

<Security TransactionID="test" Perc="l" IsCS="false" I>

<Security TransactionID="test" Perc="l" IsCS="false" I> I

</Reallocation>

<FutureElection>

<Security TransactionID="test" Perc="l" IsCS="false" I>

<Security TransactionID="test" Perc="l" IsCS="false" I>

<Security TransactionID="test" Perc="l" IsCS="false" I>

<Security TransactionID="test" Perc="l" IsCS="false" I>

<Security TransactionID="test" Perc="l" IsCS="false" I>

<Security TransactionID="test" Perc="l" IsCS="false" I>

</FutureElection>

</Account>

</UserTransaction>

</Transaction>

Disclosures

Morningstar® Retirement ManagerSM is offered by Morningstar Investment Management LLC, a registered investment adviser and subsidiary of Morningstar, Inc., and is intended for citizens or legal residents of the United States or its territories who reside in the United States or its territories.

Investment advice generated by Morningstar® Retirement ManagerSM is based on information provided and limited to the investment options available in the defined contribution plan. Projections and other information regarding the likelihood of various retirement income and/or investment outcomes are hypothetical in nature, do not reflect actual results, and are not guarantees of future results. Results may vary with each use and over time. Morningstar Investment Management is not affiliated with the Recordkeepers or employers who offer Morningstar® Retirement ManagerSM.

All investments involve risk, including the loss of principal. There can be no assurance that any financial strategy will be successful. Morningstar Investment Management does not guarantee that the results of their advice, recommendations or objectives of a strategy will be achieved.

The Easy Enroll process uses a limited amount of participant information in creating recommendations and may not consider all information relevant to the participant’s financial situation. Morningstar Investment Management encourages participants who want a more personalized experience to use the full enrollment process instead of the streamlined process. The full enrollment process allows participants to provide additional information about their retirement situation and goals so that Morningstar Retirement Manager can further customize their retirement strategy. If participants have additional assets outside of their retirement plan, have a spouse or partner they’d like Morningstar Investment Management to consider, want to restrict certain securities from being used in their retirement account, or want to change the suggestions we’ve made for them through the Easy Enroll process or see how changes would impact their retirement strategy, participants should enroll using the full enrollment process.

©2021 Morningstar Investment Management LLC. All rights reserved. The Morningstar name and logo are registered marks of Morningstar, Inc. These materials are for information and/or illustration purposes only. Morningstar Investment Management LLC is a registered investment adviser and subsidiary of Morningstar, Inc. This document includes proprietary materials of Morningstar Investment Management. Reproduction, transcription or other use, by any means, in whole or in part, without prior, written consent of Morningstar Investment Management is prohibited.